Discover Your Life Passion Now That You're Near Retirement

Discover Your Life Passion Now That You're Near Retirement

Blog Article

Child boomer retirement preparation, is much various from traditional retirement planning. Infant boomers today are being informed that they do not have enough money to retire, they will need to postpone retirement, or they will have to offer up on retirement completely. None of these hold true if they would just stop and analyze retirement way of lives that cost less to live on.

There are lots of types of investment retirement planning that you can participate in. there are several manner ins which you can end up being all set and able to handle your finances when you retire. You want to ensure that you are doing all that you can now so that you are solvent when the time comes. You can make options on your own or you can seek the help from numerous experts to get you relocating the ideal track.

Start with a figure in mind, what level of earnings would you like to get through retirement that could manage you the lifestyle you desire? Then you can work in reverse to identify just how much you need to be contributing now to attain that. Cost, of course comes into the equation. It's not always possible to commit the level one may want to due to present situations. However at least you will have a focus that was not there before.

Numerous think that they have lots of time to consider retirement. However this is not the case. It is never prematurely to begin planning for your future when you are a women-planning retirement. If you are married or not, you still have to be prepared for this time. You need to know that you are protected and that you have taken the best steps to prepare yourself and the rest of your family for what is going to lie ahead of you down the road. You will feel much more comfortable knowing that you have actually made the effort to plan this milestone out in your life.

Some people use financial coordinators to help them at this moment. Others have the ability to ask a relied on buddy what their experience has actually been. You desire to maintain a familiar quality of life in retirement. Are there things you need to quit because you will not have enough income? These are difficult choices to make and might help you choose that you wish to work longer to increase your earnings. Others might decide to retire and work part time to be able to afford what you want.

This produces a scary picture in front of us today. To turn your retirement the very best period of your life by living for yourself and do everything that you have actually not had the ability to do throughout your working life or to make your retirement an agonizing headache depends on how you prepare for it in early years of life.

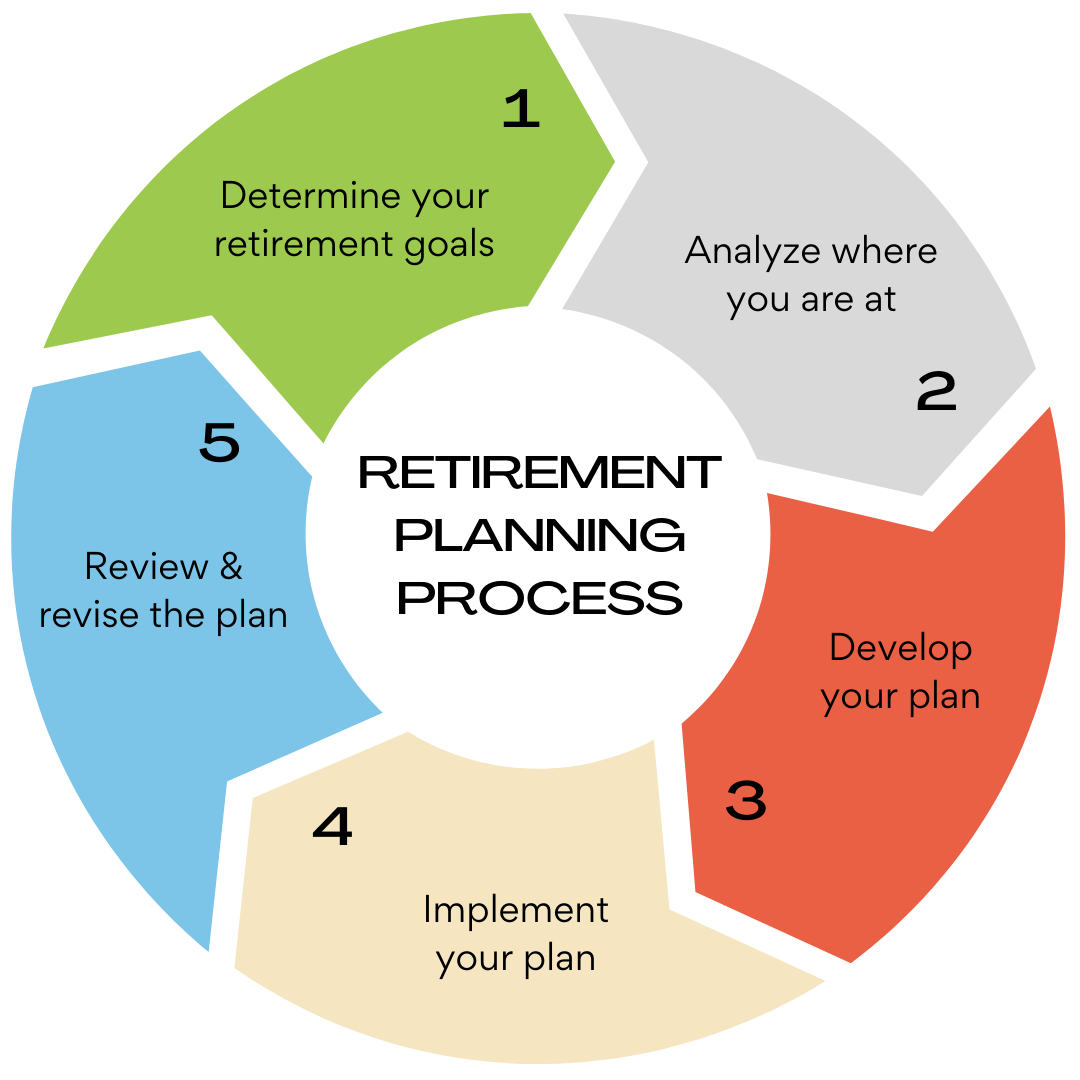

The very same holds true for what is called 'at retirement' planning. That is, people that have reached retirement and require recommendations on what to do next with their pension. The believed procedure really needs to start with what your goals are. Wealth conservation? A greater income stream now? Flexibility? When you understand more about what you desire you can be in a much better position to choose the right retirement option. In essence this is what good financial planning retirement education advice can do for you. It helps you to put yourself before your money.